How I Triple My Returns With 3x Leveraged ETFs!

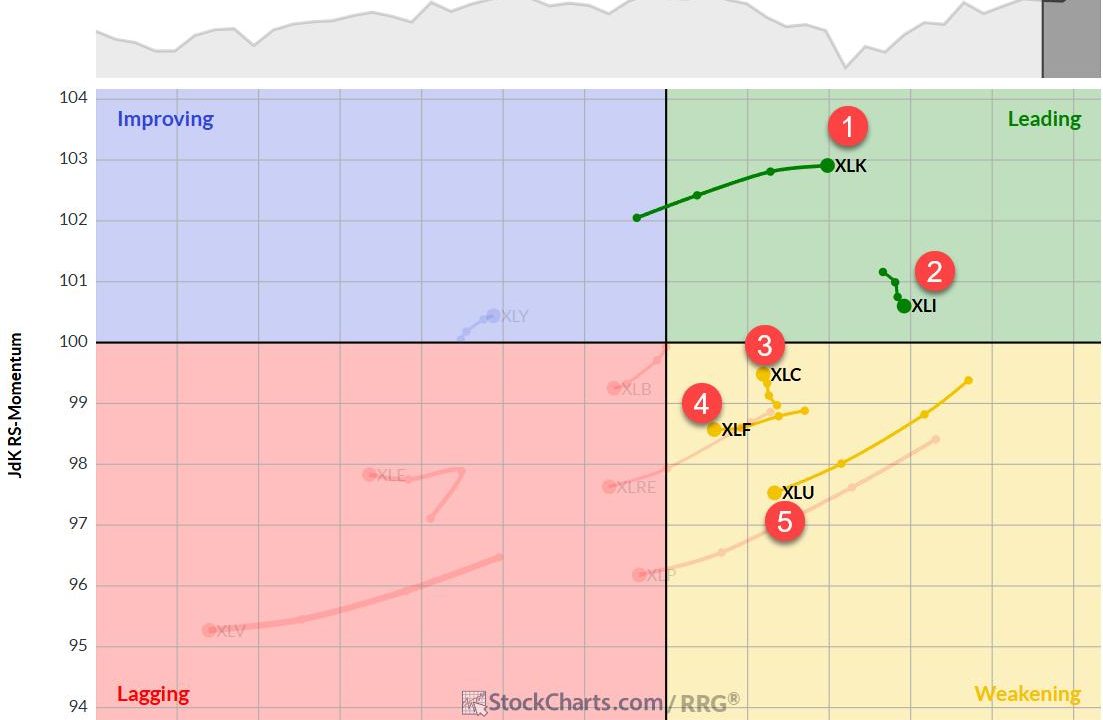

Investing in triple-leveraged ETFs may not be on your radar. But that may change after you watch this video. Tom Bowley of EarningsBeats shares how he uses the 3x leveraged ETFs to take advantage of high probability upside moves. Tom shows charts of 3x leveraged ETFs that mirror their benchmark — TNA (Russell 2000), SOXL (Semiconductors), and LABU (Biotech), and maps out how you can use the setups in these charts to multiply your returns. ...