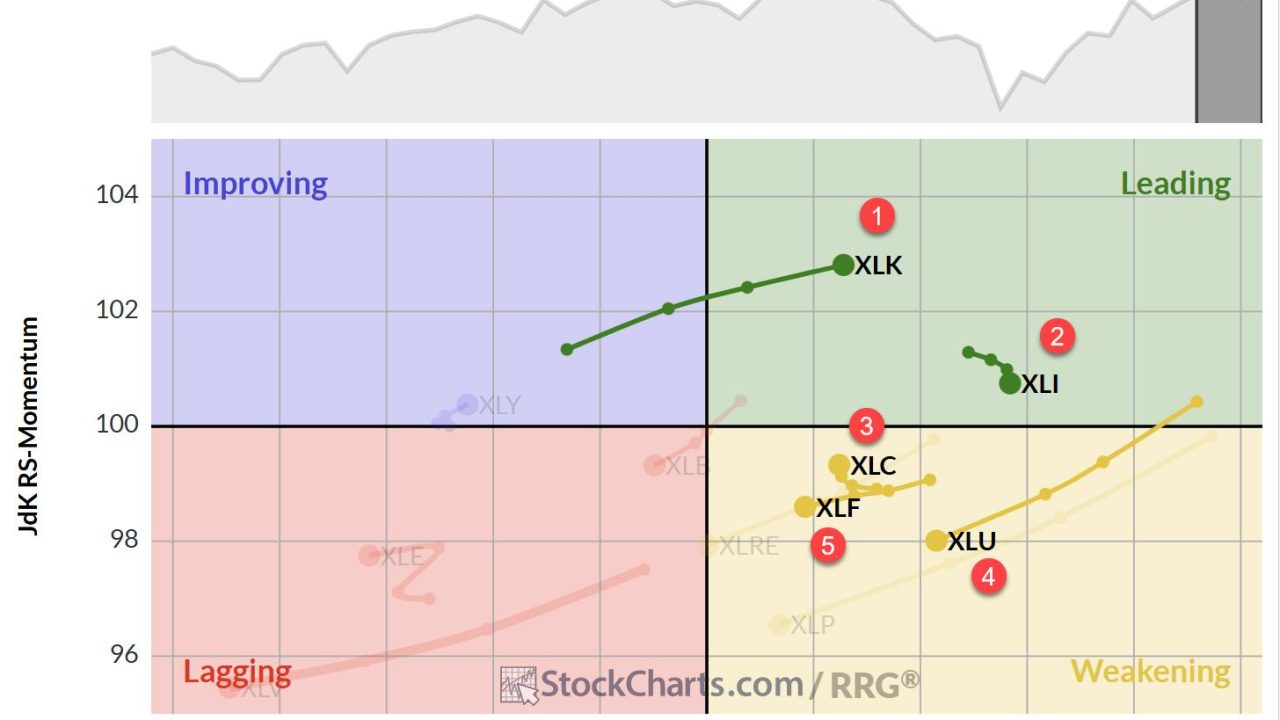

In this video, Mary Ellen spotlights key pullback opportunities and reversal setups in the wake of a strong market week, one which saw all-time highs in the S&P 500 and Nasdaq. She breaks down the semiconductor surge and explores the bullish momentum in economically-sensitive sectors, including software, regional banks, and small-caps. Watch as she highlights top stocks to add to your watchlist, including FedEx, XPO, CHRW, and RL, plus identifies downtrend reversal candidates like AeroVironment...

HomeCategory

Stocks

Below is the EB Weekly Market Report that I sent out earlier to our EarningsBeats.com members. This will give you an idea of the depth of our weekly report, which is a very small piece of our regular service offerings. We called both the stock market top in February and stock market bottom in April, and encouraged EB members to lower risk at the time of the former and increase risk at the time of...

The Best Five Sectors, #25

5 days ago9 min

A Greek Odyssey First of all, I apologize for any potential delays or inconsistencies this week. I’m currently writing this from a hotel room in Greece, surrounded by what I can only describe as the usual Greek chaos. Our flight back home was first delayed, then canceled, then rescheduled and delayed again. So instead of being back at my desk as planned, I’m getting back into the trenches from a small Greek town. But the...

Week Ahead: As NIFTY Breaks Out, Change Of Leadership Likely To Keep The Index Moving

1 week ago8 min

After six weeks of consolidation and trading in a defined range, the markets finally broke out from this formation and ended the week with gains. Over the past five sessions, the markets have largely traded with a positive undercurrent, continuing to edge higher. The trading range was wider than anticipated; the Nifty traded in an 829-point range over the past few days. Volatility took a backseat; the India Vix slumped by 9.40% to 12.39 on...

3 Stock Setups for the Second Half of 2025

1 week ago9 min

As we head into the second half of 2025, here are three stocks that present strong technical setups with favorable risk/reward profiles. One is the largest market cap stock we’re familiar with, which bodes well for the market in general. The second is an old tech giant that’s making a comeback. The third is a beaten-down S&P 500 name that may be ready to rally. Let’s dive into these three stocks. NVIDIA (NVDA) is Leading...

If you’ve looked at enough charts over time, you start to recognize classic patterns that often appear. From head-and-shoulders tops to cup-and-handle patterns, they almost jump off the page when you bring up the chart. I would definitely include Fibonacci Retracements on that list, because before I ever bring up the Fibonacci tool on StockCharts, I’m pretty confident the levels are going to line up well with the price action. Today, we’re going to look at...

All-Time Highs and An Upcoming Rate Cut: We’re Just Getting Started on This Move Higher

1 week ago9 min

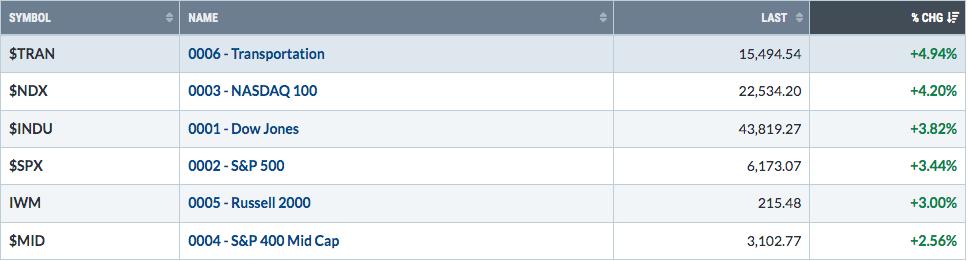

The bears are now left grasping at straws. What about tariffs? What about inflation? What about recession? What about the Fed? What about interest rates? What about the Middle East? What about the deficits? Blah, blah, blah. When it comes to the media, you need to bury your head in the sand. Actually, take your head out of the sand and bury it in the charts. That’s where you’ll find the truth. I said all-time...

Chartists can improve their odds and increase the number of opportunities by trading short-term bullish setups within bigger uptrends. The first order of business is to identify the long-term trend using a trend-following indicator. Second, chartist can turn to more granular analysis to find short-term bullish setups. Today’s example will use the Cloud Computing ETF (SKYY). *********************** TrendInvestorPro monitors a carefully curated ETF ChartList to identify the leading uptrends and find bullish setups within these...

Take a tour of the FIVE latest updates and additions to our fan-favorite, professionally-curated Market Summary dashboard with Grayson! In this video, Grayson walks viewers through the new charts and indexes that have been added to multiple panels on the page. These include mini-charts for the S&P sectors, a new index-only put/call ratio, intermarket analysis ratios to compare performance across asset classes, and a massive collection of key economic indexes that you can track like...

SMCI Stock Surges: How to Invest Wisely Now

1 week ago8 min

Over a month ago, Super Micro Computer, Inc. (SMCI) appeared on our StockCharts Technical Rank (SCTR) Top 10 list. SCTRs are an exclusive StockCharts tool that can help you quickly find stocks showing strong technical strength relative to other stocks in a similar category. Now, the stock market is dynamic, and SMCI, like many stocks, went through a consolidation period with its price trading within a certain range. While SMCI was basically moving sideways, other...