Creating content for YouTube, TikTok, Reels is more challenging than ever. As a content creator in the UK, you’re under constant pressure to produce high-quality videos quickly, consistently, and without burning out. The demand for fresh, engaging content is high, and every video has to stand out. But how can you keep up with these demands without sacrificing quality? That’s where Loova comes in. This powerful tool is helping UK content creators create content faster...

News

Magazine archive

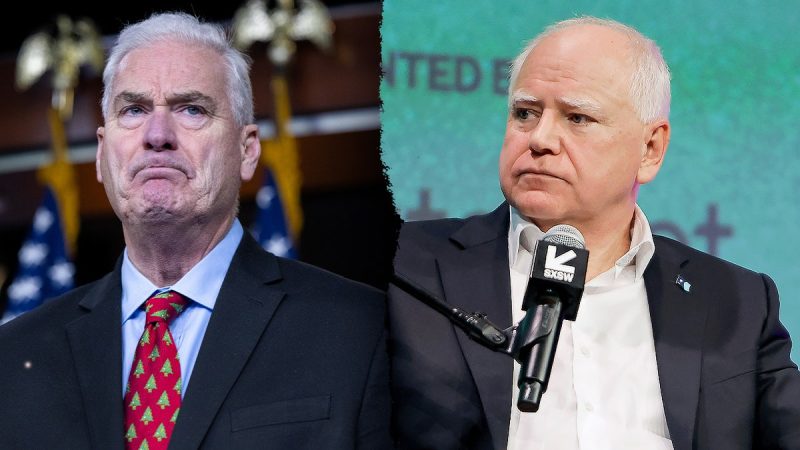

Tom Emmer calls for Tim Walz, Keith Ellison to ‘serve jail time’ if fraud coverup allegations are true

4 days ago7 min

The highest-ranking Minnesotan in Congress is calling for a deeper investigation into allegations that leaders in his state government knowingly ignored evidence of welfare fraud, and he called for those leaders to even face incarceration if proven true. ‘People are sick and tired of elected officials having a double standard, being treated differently than they are. They’re held accountable for things that they should be held accountable for, when their elected officials are not,’ House...

I spent decades inside the Pentagon watching technology reshape warfare. I saw precision munitions change the battlefield. I watched satellites compress decision cycles. But nothing compares to what is happening now. Artificial intelligence has moved the lab to the kill chain. And the showdown between Secretary of War Pete Hegseth and AI firm Anthropic is not a contract dispute. It is the opening battle over who controls the most powerful military technology of the 21st...

Iran continues firing missiles, drones at neighboring states, with multiple interceptions reported

4 days ago6 min

Iran launched a new wave of attacks on Thursday, with explosions reported in the region and Tehran threatening that the U.S. would ‘bitterly regret’ sinking an Iranian warship. Iran’s strikes on Thursday targeted Israel, American bases and countries in the region. Israel announced multiple incoming missile attacks as air raid sirens blared in Tel Aviv and Jerusalem. Azerbaijan’s Ministry of Defense on Thursday said Iran used unmanned aerial vehicles (UAVs) in an attack on Nakhchivan...

‘Shahs of Sunset’ star Reza Farahan is speaking out about the United States and Israel’s military action against Iran. During an interview with Fox News Digital, the Iranian-born 52-year-old reality star, who authored the forthcoming book ‘Memoirs of a Gay Shah,’ explained that he and his family came to America on a family trip in 1977 and ended up staying after unrest in Iran escalated into revolution. During the 1979 Iranian Revolution, the country’s former...

Morgan Stanley is set to cut around 2,500 jobs globally despite reporting record revenues last year, highlighting growing tension between strong financial performance and ongoing cost-cutting across the banking sector. The Wall Street giant plans to reduce its workforce by roughly 3 per cent across several divisions, including investment banking and trading, wealth management and investment management. The reductions, first reported by The Wall Street Journal, were understood to have begun earlier this week. The...

Airlines are facing a sharp rise in operating costs after jet fuel prices surged to their highest level in more than three years amid escalating conflict in the Middle East, raising fears of prolonged disruption to global energy supplies. The price of aviation kerosene in European markets has climbed to levels not seen since the shortages triggered during the Covid-19 pandemic, placing immediate pressure on airline margins and sending aviation stocks lower. The spike has...

US likely to introduce 15% global tariff as Trump administration revives trade strategy

5 days ago12 min

The United States is expected to raise its global tariff rate to 15 per cent in the coming days as the Trump administration moves to restore its controversial trade policies following a Supreme Court ruling that struck down last year’s sweeping import duties. US Treasury Secretary Scott Bessent said the higher tariff level was “likely” to be implemented this week, suggesting the White House intends to push ahead with a tougher global trade regime despite...

New car sales in the UK surged to their highest February level in more than two decades, highlighting continued recovery in the automotive market. However, industry figures show the transition to electric vehicles is losing momentum, with the market share of fully electric cars falling for the second consecutive month. According to data compiled by the Society of Motor Manufacturers and Traders (SMMT), more than 90,000 new vehicles were registered across Britain in February. The...

The UK government has urged employers to remove “stereotypically masculine” language from job advertisements in a bid to encourage more women to apply for roles, particularly at senior levels. The guidance has triggered a political row, with critics branding the recommendations “patronising” and unnecessary. The new advice was issued by the Office for Equality and Opportunity as part of a wider initiative aimed at reducing barriers to women entering and progressing in the workplace. Ministers...