US technology group Avalara has acquired Manchester-based integration startup Versori in a deal that underscores the growing international appeal of the UK’s regional tech sector. The value of the transaction has not been disclosed, but it includes Versori’s proprietary technology platform and its 23-strong team. Co-founders Sean Brown and Daniel Jones will remain with the business, which will operate under the name “Versori, by Avalara”. Founded in 2022, Versori specialises in next-generation integration technology, enabling...

News

Magazine archive

Bindbridge raises $3.8m to fight herbicide resistance with AI-designed crop protection

7 days ago7 min

A Cambridge ag-biotech start-up aiming to reinvent crop protection has secured $3.8 million in early-stage funding to accelerate the development of next-generation herbicides and pest control products using artificial intelligence. Bindbridge, founded in 2025 by a trio of Cambridge University scientists, is building what it describes as a category-defining platform for agriculture: an AI-driven system capable of designing “molecular glues” to target and degrade specific proteins in weeds and pests. The company believes its approach...

Iran nuclear talks ‘didn’t pass the smell test’ before Trump launched strikes, says Vance

7 days ago6 min

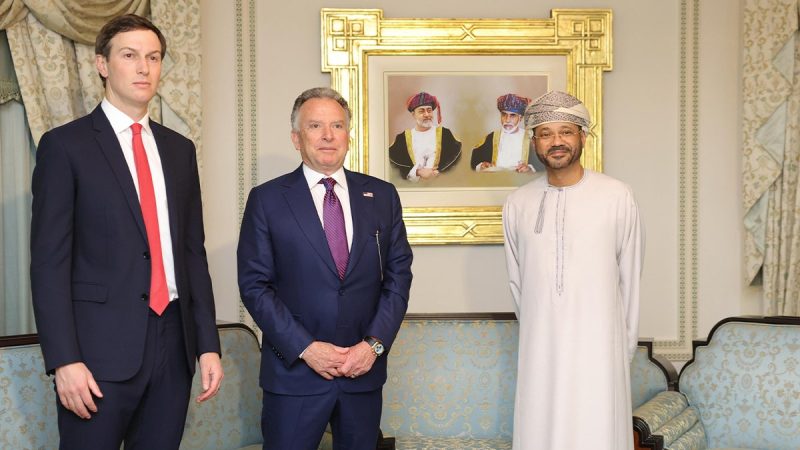

Vice President JD Vance confirmed Monday that negotiations with Iran over its nuclear program collapsed after U.S. officials concluded Tehran’s claims ‘did not pass the smell test,’ prompting President Donald Trump to authorize Operation Epic Fury. Speaking on ‘Jesse Watters Primetime,’ Vance said U.S. envoys — including Steve Witkoff, Secretary of State Marco Rubio and Jared Kushner — had conducted rounds of ‘deliberate’ talks in Geneva with the Iranian delegation. The discussions were aimed at...

Iranian drone strikes shut down Qatar LNG production facilities, as energy prices surge

7 days ago4 min

Iranian drone strikes forced Qatar to halt liquefied natural gas (LNG) production Monday, jolting global energy markets and raising fears about supply disruptions as Tehran increased its attacks on regional infrastructure. QatarEnergy, the state-owned giant and one of the world’s largest LNG producers, suspended operations at two facilities after drones launched from Iran hit the sites, according to reports. Qatar’s Ministry of Defense also said in a statement, that two drones hit facilities in the...

President Donald Trump on Monday sent an official notification to Congress about the U.S. strikes against Iran, in which he attempted to justify the military action in the now expanding conflict in the Middle East. In a letter obtained by FOX News, Trump told Senate President Pro Tempore Chuck Grassley, R-Iowa, that ‘no U.S. ground forces were used in these strikes’ and that the mission ‘was planned and executed in a manner designed to minimize civilian...

X’s artificial intelligence chatbot Grok has begun rolling out its first beta version of Grok 4.20, which Elon Musk and X say will provide not only better performance and new features but also the least ‘politically correct’ platform in terms of liberal bias. Over the past week, users on X, including Musk, have been touting search results from Grok showing ‘non woke’ answers to questions about popular cultural issues and figures compared to results from...

Trump admin warned lawmakers Israel was ‘determined to act with or without us’ before massive Iran strikes

7 days ago9 min

Speaker Mike Johnson, R-La., described the recent U.S.-Israeli strikes on Iran as a defensive measure, saying, ‘Israel was determined to act with or without us’ following a classified briefing on Monday evening. Johnson told reporters after the briefing that Israel viewed Iran’s capabilities as an existential threat and was prepared to conduct operations regardless of U.S. participation. He said Israel’s assessment shaped American deliberations, and it was ‘determined to act in their own defense here,...

Iran starts ‘indiscriminate’ strikes across Gulf of Oman, hits shadow tanker tied to regime

7 days ago5 min

Iran is conducting ‘indiscriminate’ targeting of vessels across the Gulf of Oman and the wider Persian Gulf following the launch of U.S.-Israeli strikes under Operation Epic Fury, according to a maritime intelligence firm. Windward AI noted the sanctioned Palau-flagged tanker Skylight was hit as the conflict across the Middle East entered its second day, with the tanker also holding Iranian nationals among the crew and ties to the regime. ‘Analysis of vessel affiliations, targeting patterns,...

Secretary of War Pete Hegseth warned that some traditional U.S. allies are ‘hemming and hawing about the use of force’ as Washington presses forward with its campaign against Iran, raising fresh questions about NATO cohesion at a moment of escalation. Spain has refused U.S. permission to use certain bases for strikes on Iran, calling for de-escalation and adherence to international law. Turkey has criticized the operation and warned of broader regional destabilization, while President Recep...

What does it take to lead in two very different industries — automotive operations and golf management — and succeed in both? For Don Carlos Lee Gibson Jr., the answer is simple: structure, discipline, and people-first leadership. “I’ve always believed leadership starts with responsibility,” Don says. “If you take care of your people and your systems, the results follow.” His career tells that story. Early Life and Education: Where Discipline Began Don’s foundation started at...